Businesses

Companies and retirement plan sponsors benefit from Bailey Investments Group's disciplined process and enhanced service in order to attain greater confidence in retirement plan management. At the same time we are passionately driven to ensure that all employees gain knowledge and guidance in their plan, and how to best apply this to their individual situation.

Click a subject below to learn more:

|

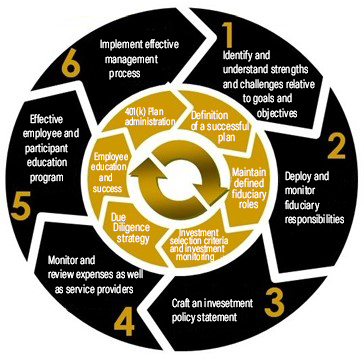

Well managed retirement plans have fundamental elements that are evidenced through the fiduciary process. This is a disciplined process that ensures your retirement plan follows ERISA guidelines and well as best practices.

|

|

The Investment Policy Statement should be developed and updated. The IPS is not required by law but it is a document that regulators and the Department of Labor will review when they conduct an audit. A carefully crafted IPS includes:

|

|

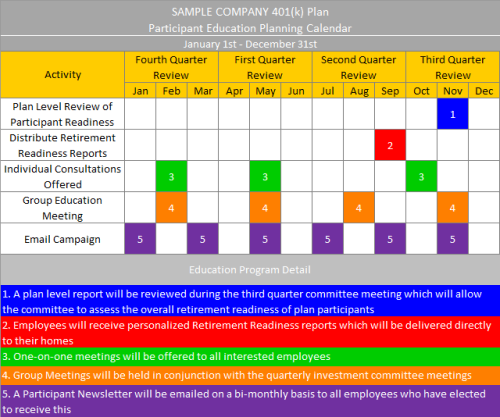

Business is extremely competitive, not only for customers, but also valuable employees. Making sure your employees have access to and effectively utilize the retirement plan is paramount to creating greater morale and loyalty. We will be the opportunity for your employee corps to learn how the plan works for them, their families, and how to customize their strategy based on their goals. Financial stress among your employees will be reduced, peace of mind will increase as well as productivity. What we have found is that with greater education and knowledge, there are substantial increase in participation. Importantly, your employees gain a greater appreciation for you and your company as they realize how the plan you provide impacts their lives far into the future. We implement this with a robust personal service strategy and schedule designed to be provided for all in your company. (Includes a service schedule and calendar)

|

|

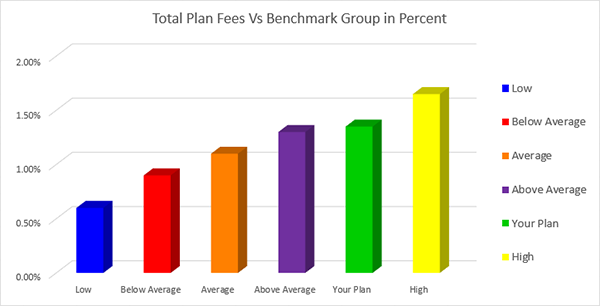

It is a Fiduciary’s responsibility to ensure the participants do not pay excessive fees.

|

|

Implementing a prudent plan management process is imperative for the execution of proper governance. Managing a plan involves liabilities and risks that can, with guidance, be mitigated for the HR manager, CEO, CFO, and anyone who takes on a fiduciary role with the plan. Bailey Investments Group employs a disciplined process, and professional resources to conduct a comprehensive risk analysis to reveal what is being done right, and where certain risks may be lurking. |

|

|

Maintain a state of the art understanding of your retirement plan’s functions, fee structure, success, risk reduction, performance, and best practices in relation to other employers and plan providers. |

How do the Plan fees compare

How do the Plan fees compare ① Identify and understand strengths and challenges relative to goals and objectives

① Identify and understand strengths and challenges relative to goals and objectives